An Incredible Week in Crypto Lore

Sanat Rao

Jan 26, 2025

As the saying goes, “there are decades where nothing happens, and weeks where decades happen”. While the crypto industry is rarely short on excitement, the past week stands out as a defining moment in the evolution of digital assets—a week destined to be etched in crypto lore!

In this article, we explore the key developments that unfolded, their implications for the industry, and the signals they send for the future.

Disclaimer:

The above reflects the views of the investor and should NOT be construed as investment advice, financial advice or legal advice.

This information is purely educational and is NOT meant to be taken as a recommendation to buy or sell any product or service. Please do your own research before making any decisions.

Where relevant, direct quotes & passages have been taken from whitepapers, articles and blog posts, with their sources cited.

I. President Trump signs Executive Order on Crypto

In a landmark move, President Trump signed an executive order on Thursday creating a President’s Working Group on Digital Assets. This initiative, chaired by David Sacks, aims to position the US as the crypto capital of the world.

While the executive order itself signals intent rather than specific policy, it heralds a fundamental shift in US policy towards digital assets and its implications for the industry are undeniably bullish. Here are the key highlights:

A Framework for Positive Regulation

Job#1 for the working group is to create a new federal regulatory framework for crypto within 180 days. This marks a dramatic shift from the previous administration’s adversarial “regulation by enforcement” stance.

We can expect to see clear guidelines for issuance of digital assets in the US, clarification of the regulatory status of various types of crypto (securities vs. commodities), etc.

2. Potential End to Operation Chokepoint2.0

Operation Chokepoint 2.0 [a term created by the legendary Nic Carter] refers to the Biden administration’s alleged efforts to restrict the cryptocurrency industry's access to banking services. Enforcement actions by various regulators (SEC, FDIC etc) effectively discouraged banks from providing banking services to crypto firms.

Trump’s executive order does not end Chokepoint2.0, but lays the groundwork for future positive regulations. Notable language includes:

Protecting the right to access blockchain networks without censorship.

Ensuring fair access to banking services for law-abiding entities and individuals.

3. National Digital Asset Stockpile

The working group will explore the creation of a national crypto stockpile, potentially derived from crypto lawfully seized by the Federal Government. Though distinct from a Bitcoin Strategic Reserve, it signals an “America First” approach to digital assets.

Meanwhile, Sen Cynthia Lummis has been named the first-ever chair of a newly created Senate Banking Subcommittee on Digital Assets. She has been a strong advocate of the US establishing a Strategic Bitcoin Reserve (SBR) and has pushed for the US to purchase 200,000 BTC every year for 5 years (total of 1M BTC). This aligns with state-level efforts, such as Ohio has proposed bill to allocate 10% of state funds to crypto

4. US-Dollar backed Stablecoins

The order emphasizes the importance of stablecoins in maintaining the U.S. dollar’s dominance as the world’s reserve currency. Interestingly, it prohibits the creation of a central bank digital currency (CBDC), opting instead for a decentralized approach

II. President Trump and Melania launch Memecoins

In a move as polarizing as it is impactful, President Trump and First Lady Melania announced the launch of their own memecoins—$TRUMP and $MELANIA—on the Truth Social platform ahead of the inauguration.

Within 24 hours of launching, the meme token rose 580% in value, topping $75 which reflects a fully diluted valuation (FDV) of $75B.

Implications:

While many crypto insiders viewed the launch as predatory and damaging to the industry's reputation, $TRUMP also sets a precedent for future token launches. i.e it is now open season for memecoins.

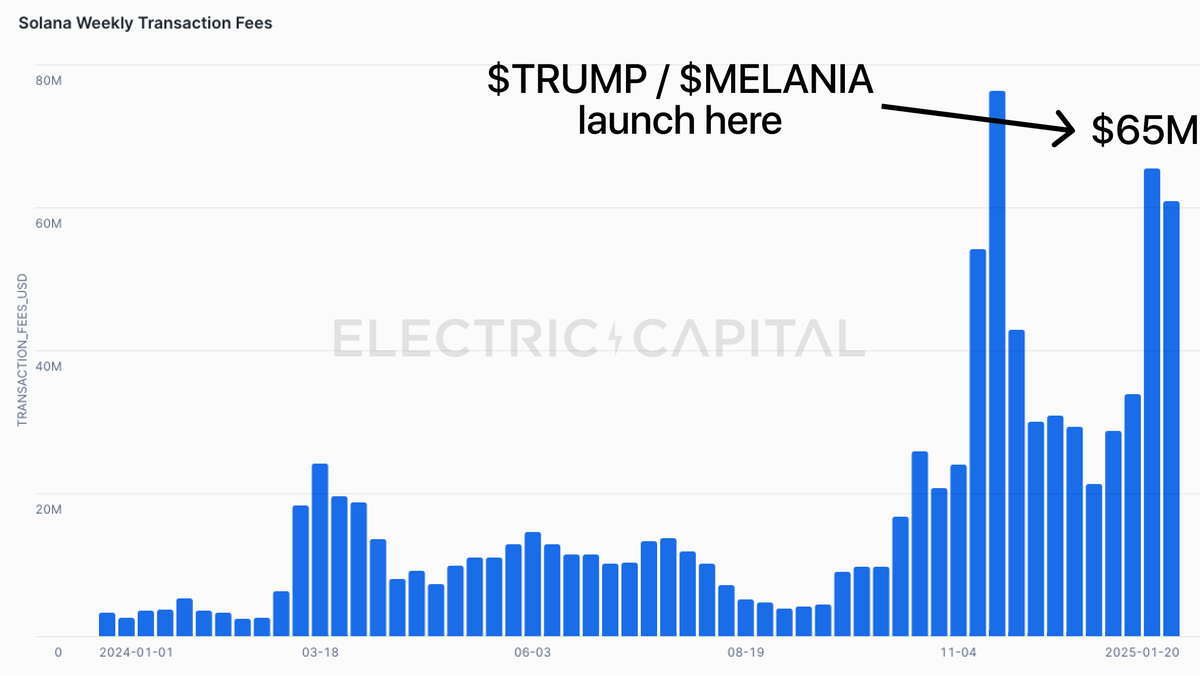

Memecoins are hugely bullish for the Solana ecosystem. Electric Capital estimates that solana made $63M in weekly transaction fees [up 93% from the week earlier] from these tokens alone

3. A recent Chanalysis report shows that 46.5% of all $TRUMP and $MELANIA token holders were first time crypto users (at least first time SOL addresses), implying that memecoins are a great way to bring in new users top crypto

Source: Chainalysis

However, as Rob Hadick from Dragonfly points out, these wallets have since not transacted with any other application and it is too early to call this a “mass onboarding” event.

III. Wave of New Crypto ETF Applications filed

With the SEC approving spot Bitcoin and Ethereum ETFs in 2024, the crypto ETF market has surged to $127 billion in assets under management (AUM)

In anticipation of the new pro-crypto regulatory environment, this week alone saw more than 30 new ETF applications, with a strong focus on Solana and XRP.

Crypto ETF Filings as of Jan 25, 2025 [Source: Weissratings]

IV. SEC rescinds SAB121

What was SAB121: Staff Accounting Bulletin No. 121 (SAB 121) was a controversial accounting rule issued by the U.S. Securities and Exchange Commission (SEC) in March 2022. It required banks holding crypto assets for customers in a custodial capacity to record those holdings as liabilities on their balance sheets. This created significant operational and financial burdens for banks and custodians, effectively discouraging them from providing bitcoin-related services.

What has changed

SEC has now moved to rescind SAB121 with SAB122, which provides more accounting flexibility for banks in crypto-related reporting,

The SEC also has launched a new crypto taskforce under Hester Pierce, who has been very supportive of crypto regulations in the past.

Implications:

We expect banks to move swiftly to integrate bitcoin and crypto custody services into their offerings. This means you could soon be holding Bitcoin along with Tesla stock & bonds in your Schwab portfolio.

V. Trump pardons Silk Road creator Ross Ulbricht

In a historic decision, Donald Trump signed an order granting a full pardon to Ross Ulbricht, the founder of the marketplace Silk Road. Launched in 2011, Silk Road demonstrated the potential for decentralized, censorship-resistant money but also drew criticism for facilitating illicit trade.

This pardon is being seen as a triumph for the crypto industry, signaling a positive shift in how innovators and startups will be treated by the government when they push the boundaries of innovation.

VI. Crypto AI Agents continue to grow

Crypto AI agents are one of the most exciting developments in the last few months: intelligent tools that automate everything from trading to managing blockchain tasks.

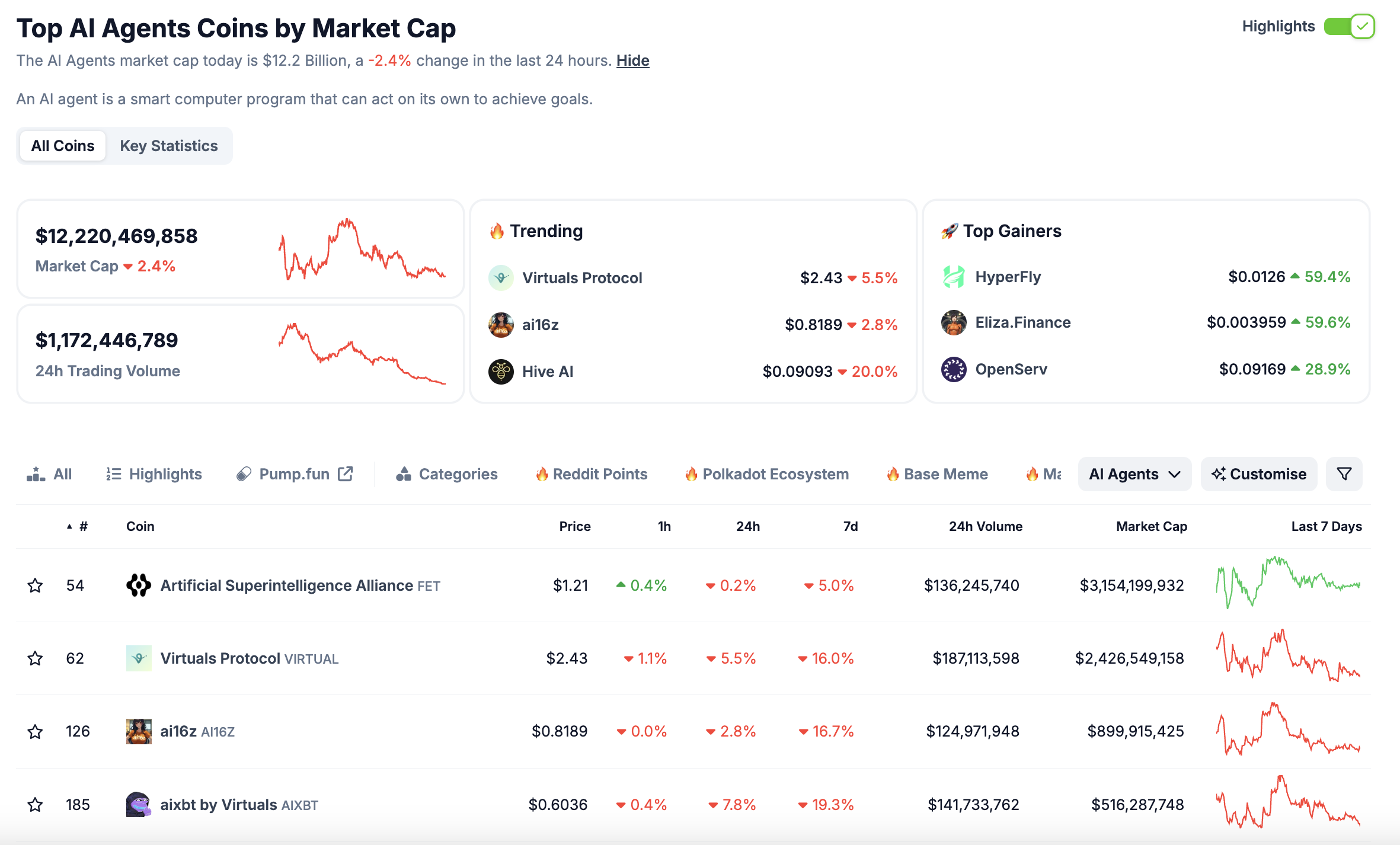

The crypto AI agent market cap today stands at $12.2B, according to CoinGecko.

VII. BTC close to its all time high

Amid these developments, Bitcoin reached a new all-time high of $108,228 on January 20, with a market capitalization of $2.08 trillion. This milestone underscores growing confidence in crypto as both a technology and an asset class.

Source: CoinGecko

VIII. Deepseek R1 Open Source Model launched

And last but not least, Deepseek, a relatively unknown Chinese company, announced its new open-source reasoning model Deepseek R1. DeepSeek R1 specializes in logical inference, mathematical problem-solving, and real-time decision-making, rather than traditional language models.

Based on early reports, Deepseek R1 delivers performance comparable to leading models like OpenAI’s reasoning engine o1 and Anthropic’s Claude 3.5 Sonnet *while operating at 2% of the cost cost*.

Deepseek’s approach departs from traditional methods as follows:

Mixture-of-Experts Architecture

DeepSeek’s models utilize an MoE architecture, activating only a small fraction of their parameters for any given task. This “selective activation “significantly lowers computational costs

Reinforcement Learning

Unlike traditional methods which rely heavily on supervised fine-tuning, DeepSeek employs pure RL, allowing models to learn through trial and error and self-improve through algorithmic feedback.

Distillation

DeepSeek employs distillation techniques to transfer the knowledge and capabilities of larger models into smaller, more efficient ones.

More on Deepsink and other models in a future blog post

Final Thoughts

This week has been nothing short of revolutionary for the crypto industry. From regulatory breakthroughs to memecoin mania and Bitcoin’s record high, the developments signal a growing ecosystem with vast potential.